Silver Prices All Set To Rise!

2020 has only just started but oddly enough, has already witnessed the worst of market scenarios and global economic paralysis. Despite the massive economic fall and unpredictable markets due to the present situation, COVID19, the commodities have fallen radically even in an uncertain market. As many would have guessed that metals would have risen and soared, the scenario turned out to be quite divergent.

As the market reacted in the opposite direction, very contrary to the popular belief, a lot of investors were stung by huge losses. To combat the situation and tackle losses, investors have been selling their metal holdings to raise cash, but for how long? The price highs seen at the start of this year proved just too appealing for investors facing losses elsewhere, particularly in stricken global stock markets, to exit in profits. They cashed out of silver and gold to cover their initial losses, which naturally seemed the best way out.

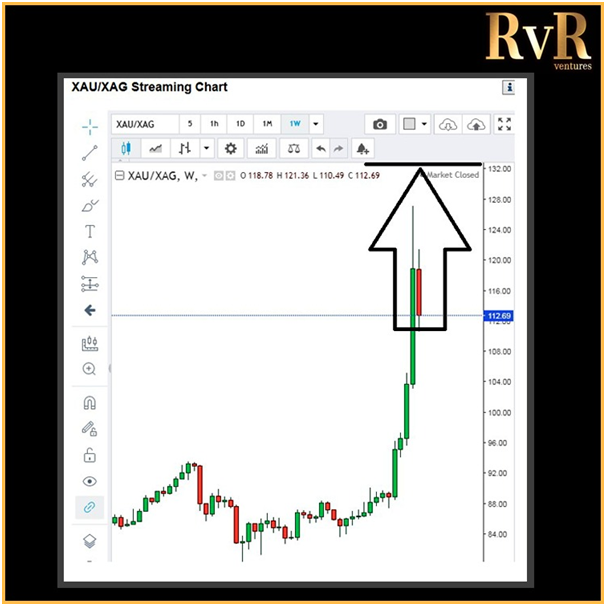

As explained in the graph below, we can clearly see the pattern followed by the metal:

This process, however, seems to be in its final stage to as it may be winding down and ramping up. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. The Coronavirus will mean a possible shutdown and other blockages for gold and silver production just as it will for most other commodities. There are already reports of massive disruption in silver supply from major producers, like in Chile, Argentina and Peru. The lack of production and scarcity in the supply will naturally give silver a boom in the price section. The silver prices will go up, compared to the flow of the commodity and the demand.

This process, however, seems to be in its final stage to as it may be winding down and ramping up. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. The Coronavirus will mean a possible shutdown and other blockages for gold and silver production just as it will for most other commodities. There are already reports of massive disruption in silver supply from major producers, like in Chile, Argentina and Peru. The lack of production and scarcity in the supply will naturally give silver a boom in the price section. The silver prices will go up, compared to the flow of the commodity and the demand.

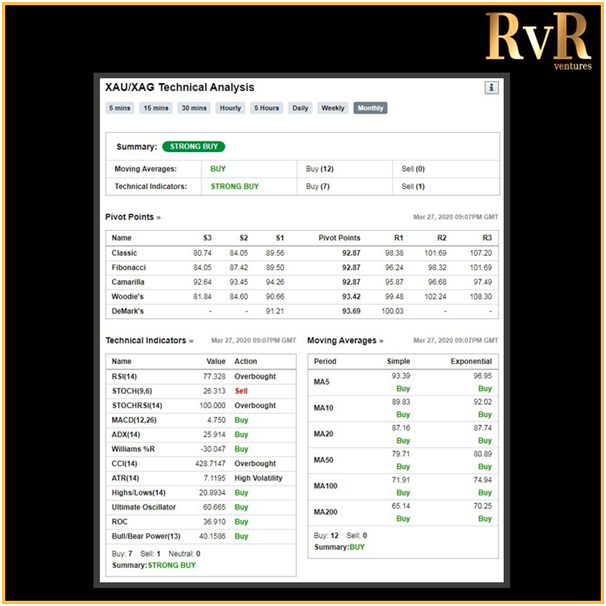

Other than this, the Federal Reserve revealed extraordinary measures allowing its monetary watchdogs to buy Treasuries and agency mortgage-backed securities ‘in the amounts needed’. This is effectively unrestricted Quantitative Easing. This week, things have changed with prized metal prices rising again as markets move to price in long-term credit easing, stimulus and weak growth.

One of the biggest shockers that moved the world is the fact the US has now become the epicentre of the pandemic, surpassing the number of cases in China itself. Surely, the situation will not be easy after this.

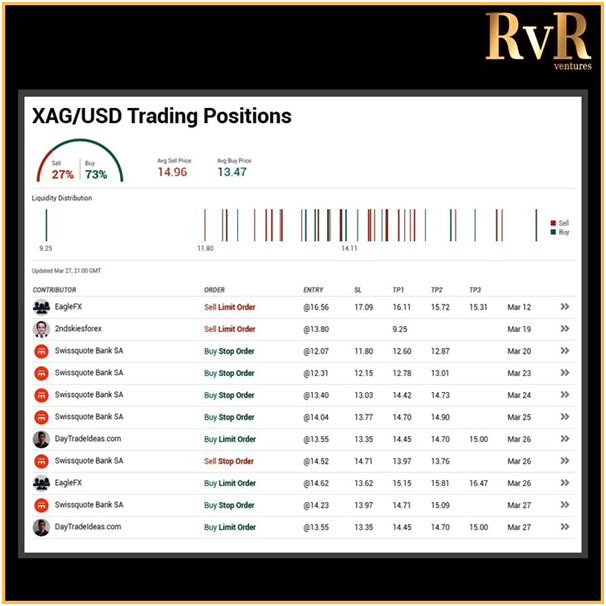

In conclusion, the uncertainty in the market is not going to be annihilated any time soon. As per the top analysts, banks, traders: 15.5 is the next target, and then a fall till 13.5 – 14.0 range and then a rally to 16.3/16.5 range subject to Fed, Interest Rate deduction, QE.

Of course, it should be no surprise that this move gave precious metals a lift. One function they fulfil in the markets is as ballast to so-called fiat currencies backed by nothing more than the full faith and credit of their various administrations.